Rafizi gave a sarcastic and patronising reply to Opposition Leader, Hamzah Zainuddin attempt to give a political spin to the growth statistic data in Parliament.

Economic growth will be the issue opposition intend to dwell on to gain political points despite knowing well there is an impending global recession and current inflationary concern.

It is expecting too much to pursue high growth now.

Debt concern

A market watcher suggested the revision for the 2023 budget to be tabled on Friday should focus on flattening the continuous decline on the state of the economy since 2016.

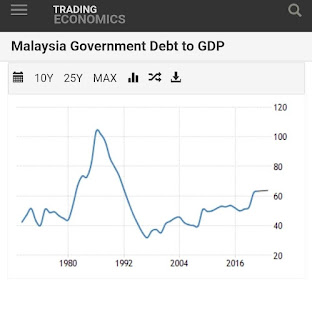

Among the concern of market and rating agencies is ever rising debt.

There are views that the debt level of Malaysia is comparably lower to other countries and advocate government spending through borrowing to tide through the impending global recession.

However one bad review from rating agency and the market will come crashing. Malaysia is not US or Japan or Western Europe or China to be compared to or using their policies for justification.

At about 60% debt (debt ceiling raised by Muhyiddin from 55% to 65%), Malaysia debt to GDP ratio is lower than Singapore but Malaysia is not a financial centre with free flow of capital. Inflow to buy ringgit is not as continuous as the outflow to other currency.

Noticeable from the chart that debt is contiously rising.

What growth 2022?

The recent self-praising by the PN side and pro-Ismail Sabri UMNO supporters on the 8.6% GDP growth is misleading.

It is necessary to comment and put the status on the growth of the Malaysian economy in the right context.

The gloating comment left economic watchers gasping with awe to the sheer naivety in their understanding of economics.

The growth for 2022 comes about from a low base after negative growth for 2020 and dismal growth for 2021.

It needed an equivalent of almost 2 years of prime priming of RM600 billion in which Muhyiddin government may have blatantly squandered to finance PN's GE15 warchest.

It was both the Covid-19 pandemic and his bad handling for ulterior motive that detoured Malaysia from its destined growth path (see chart above).

Johari Gani's expressed concern in Parliament for the negative growth for the 4th quarter for 2022. He higlighted other countries in the region are doing better than Malaysia.

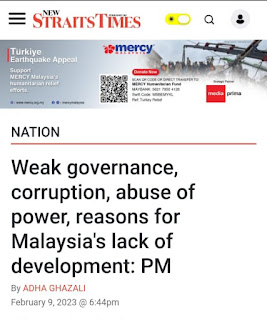

It is a long held view that Malaysia is undergoing the long term effect of Mahathirism and his politics is showing its toll.

Global recession concern

Global recession seemed inevitable indicated by the empty containers lining up ports and 25% drop in trade through Singapore port.

An analyst suggested private sector to invest and pump prime the economy. The suggestion only indicate government's limited capacity and the level of confidence on the forecast does not seemed high.

Growth should not be priority but food. More so, should the Ukraine war burst into a nuclear war and God forbid, World War 3 breakout.

A hint of the possible budget revision is touched by Deputy Finance Minister, Dato Ahmad Maslan in Parliament yesterday (refer to You Tube video here from 1:42).

His post Parliament press conference here stressed on debt reduction management. The likelihood Anwar Ibrahim will table a revision to reduce debt to avoid a bad review from rating agencies.

He would likely reduce budget. Spending maintained by pursuing a more efficient fiscal management and introduce targeted subsidy.

Most likely, there will be a serious effort to reduce waste, and leakage, improve good governance and pursue on corruption offenders. All from past Buku Jingga election manifesto of Pakatan Rakyat.

It reminded of sister's blog Another Brick in the Wall reply to then Minister of Finance 2, Husni Hanazlah challenge to show where to reduce budget.

A list of 100 was posted with combating corruption taking the bulk of the list.

Growth for 2023 and beyond

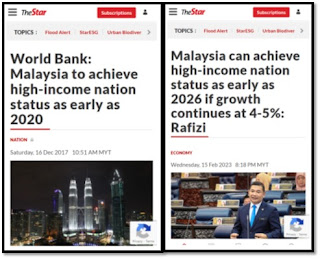

The forecast for 2023 with a budget constrained by interest repayment on debt nearing the 15% limit is expected to slowdown significantly and its between 4 to 5% depending on how the budget works out.

For what is worth, Edge Weekly commentary on GDP growth for 2023 and beyond below:

Exceptional 2022 GDP growth of 8.7% shines the spotlight on 2023 and beyond

Cindy Yeap/The Edge Malaysia

February 20, 2023 16:00 pm +08

MALAYSIA’s economy expectedly grew faster than the official 2022 growth forecast of 6.5% to 7% by more than a full percentage point — topping 8% for the first time in 22 years and putting growth among the highest in the world.

Even though at least nine experts had expected Malaysia’s 2022 gross domestic product (GDP) growth to top 9% year on year, actual headline growth of 8.7% still came in ahead of consensus estimates: Median expectations among 35 houses polled were 8.5% and had averaged 8.3%, according to Bloomberg data at the time of writing.

Yet, given challenges ahead, last year’s exceptional 8.7% headline GDP growth only accentuates the need for the country to step up overdue strategic reforms to finally attain the long-desired digitally driven, high-income developed nation status and remain one for the long haul.

While headline GDP may well be just another number to the man in the street, especially those struggling with the rise in cost of living, it is important that economic growth momentum is sustained. More on this later.

Those familiar with Malaysia would know the country was among the world’s fastest-growing economies in modern history, with annual growth rates of 9% between 1967 and 1997 — more than double the current average of 4%.

In the decade between 1988 and 1997, ahead of the 1997/98 Asian financial crisis, Malaysia’s GDP had grown an average of 9.3% a year, reaching as high as 10% in 1996 and still saw 7.3% growth in 1997, according to data from the Department of Statistics Malaysia.

Headline 2022 GDP growth would have beaten the 8.9% GDP growth in 2000 and been at a 26-year high if growth in the fourth quarter of 2022 had been above 7.5% instead of at 7%, back-of-the-envelope calculations show. This is still ahead of Bloomberg consensus of only 6.7% for 4Q2022.

Apart from still-robust private consumption, a rise in investments, higher net exports and a recovery in tourism-related activities, chief statistician Datuk Seri Mohd Uzir Mahidin also noted that inbound travel expenditure of RM27.9 billion in 2022 had improved from 2021 but was still only one-third of the pre-pandemic RM82.1 billion. Meanwhile, outbound travel expenditure had increased to RM29.6 billion in 2022, about half of RM51.3 billion recorded pre-pandemic.

Bank Negara Malaysia governor Tan Sri Nor Shamsiah Mohd Yunus, who announced the 2022 full-year GDP numbers, alongside Mohd Uzir last Friday (Feb 10), said an update to Malaysia’s 2023 official GDP growth forecasts — which currently stand at 4% to 5% — will be given on Feb 24 when Prime Minister and Finance Minister Datuk Seri Anwar Ibrahim re-tables Budget 2023.

Asked for guidance on the 2023 growth forecast, Nor Shamsiah said those reading the numbers should take into account a “higher base effect”. She had earlier stressed at least three times at the media briefing last Friday that Malaysia would not see a recession in 2023. In her presentation, Nor Shamsiah said risks to growth “remain tilted to the downside” on external factors, listing “a faster-than-expected implementation of investment following reforms”, larger improvements in tourism, stronger-than-expected domestic income and employment growth as well as a realisation of global pent-up demand as among factors that could help 2023 GDP growth come in faster than expected.

In a statement on Feb 10, Anwar had noted expectations of slowing global growth in 2023 but added that the upcoming Budget 2023 would underline the government’s continued support for economic growth and bolster private sector confidence to maintain economic growth momentum for the well-being of the people.

Lifting the average to 6%

Prior to the 4Q2022 GDP data release on Feb 10, Ndiamé Diop, World Bank Group country director for Brunei, Malaysia, the Philippines and Thailand, had spoken about the need for Malaysia to step up strategic reforms and investments to lift average annual growth to 6%, from 4% now.

“Malaysia can and should do more than 4% [long-term annual average growth rate]. It is really important for Malaysia to jack up that growth [rate] from 4% to 6%, as that would mean, in good times, you can get 7% and bad times 5% [and] we do see opportunities for Malaysia to get from 4% [annual average] to 6%. A big one is what is happening to global investments,” Diop said at the launch of the World Bank’s latest Malaysia Economic Monitor (MEM) on Feb 9.

“FDI [foreign direct investment] is being reallocated globally [on the back of geopolitical concerns]. Malaysia is well-placed to capture some of those flows,” he says, also highlighting the benefits of harnessing digitalisation. “Greater digital inclusion can help Malaysia boost productivity growth and maybe reverse the slowdown in productivity growth.

“In absence of fiscal reforms, [higher GDP growth would] allow you to spend more and, hopefully, spend better.”

Diop, who is also a trained economist, adds that Malaysia’s debt-to-GDP levels would also improve with higher growth even as the country executes fiscal reforms.

Digitalisation key to lifting productivity

“Digitalisation is a key driver of total factor productivity, which is of critical importance to Asian countries like Malaysia, where productivity growth had been lagging its aspirational peers even before the pandemic,” World Bank researchers write in the MEM report.

Among other things, researchers had flagged evidence of demand for advanced digital skills in Malaysia “increasing more rapidly than supply”, despite the shortage being known for at least six years.

Noting that Malaysia already has a Digital Government Competency and Capability Readiness framework from 2019, the World Bank researchers say in the MEM that “allocation of sufficient budget and monitoring of results indicators focused on digital skill building are needed”. To enable more effective coordination and execution of socioeconomic development programmes, the interoperability of government portals as well as existing government administrative databases need to be improved, say the researchers.

Indeed, Malaysia knows what needs to be done. The MEM lists at least four of the country’s key policy documents that stress the importance of digitalisation in achieving the country’s development objectives.

These documents include Malaysia’s Digital Economy Blueprint (MyDigital) — launched in 2021 as a roadmap for digital transformation through 2030 — which Minister of Economy Mohd Rafizi Ramli said was “one of the first things” he went through when appointed to office.

“These blueprints have been there for a while. It is a question of making sure that they are translated into policies [and execution]. With about eight years to [2030], we have to make sure we fully make use of the time to realise the many objectives of the blueprint [aimed at] enhancing digital economy, strengthening human capital and strategic capacity,” Rafizi said at the MEM launch last Thursday.

Rafizi, who is overseeing the mid-term review of the 12th Malaysia Plan to be released later this year, also acknowledged the need to accelerate reforms and embrace digitalisation “to not just withstand challenges ahead but also realise a lot of unfulfilled potential in this country”.

While it is impossible to plan everything in advance, Bank Negara deputy governor Datuk Shaik Abdul Rasheed Abdul Ghaffour, who also spoke at the launch of the MEM, rightly said Malaysia could “position [itself] as and when opportunities arise” by “getting it right on policies, platforms and people”.

Given that digitalisation is fast-evolving, formidable and irreversible and that a truly digital society can only be built when there is buy-in from all levels of society, Abdul Rasheed said “[the people] must strive together as a nation to formulate solutions for a digital Malaysia” — not only to address the many challenges faced by society but also guard against potential threats.

Drawing wisdom from the past, Abdul Rasheed borrowed a quote from Abraham Lincoln: “The best way to predict the future is to create it.”

To build the future, Malaysian society as a whole needs to become creators and innovators of technology, instead of just users of it. That at least five million Malaysians made their first digital merchant payment after the Covid-19 pandemic began is encouraging, but far from where society and the country need to be.

Its worrisome that Parliamentarians are only concerned with playing politics and only a handful understand and discuss pertinent economic issue. Wong Chen recent comment for Petronas IPO failed to understand the economic risk beyond the political rhetorics for accountability, transparency and good governance.

No comments:

Post a Comment