In this blog's February 13th posting here, there were 13 why (including how, what and did they) posed but no answers found in the media or online.

There was a created dispute among the founders of Revenue Group Berhad ("Revenue"). The "salesman" Managing Director, Eddie Ng Chee Siong ousted the Company "brains" in the Ng brothers of Brian and Dino with help from outside.

Coincidentally, MACC freeze the accounts and CDS of the brothers worth tens of millions based on alleged wrongdoing over company car and thermal paper orders worth RM400,000.

A serious oversight or gross abuse on the part of the Director of Investigation or AMLA at MACC. The allegation has no corruption in nature for them to act and originated from MACC own report.

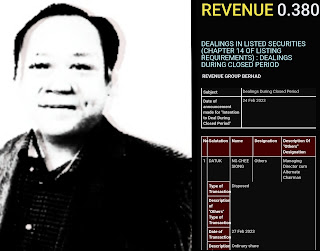

In midst of the company turmoil, Bursa suddenly reported Eddie blatantly selling his shares a day prior to announcing a poor quarterly financial results.

That is outright insider tradingoutright insider trading. And, it would be strange for SC to not investigate and charge. The alleged insider trading could certainly shed a new light on the company.

Is something insidious happening behind the payment gateway company?

Insider trading

In the midst accolade given to Revenue by Forbes, Eddie was selling the shares of his company and institutional investors got stuck with more shares than owned by the Managing Director.

The suckers are more confident in the company than the CEO himself.

The blog nuclearbursaman picked up where we left off in his February 27th posting here. He had over heard talk of an executive director planning to sell 10 million shares at 33 sen.

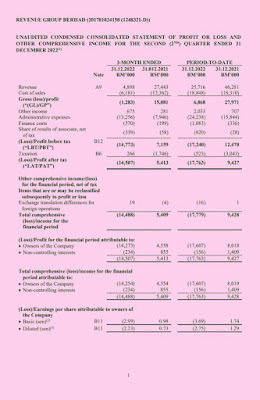

On 28 February 2023 the next day, the quarterly results for period ended 31 December 2022 showed Revenue making about RM14 million in losses.

The Bursa website disclosure confirmed nuclearbursaman and a day earlier on 27 February 2023, Eddie disposed 14,827,300 shares (3.075%) thereby reducing his stake to 5.256%

"Can a managing director cum Chairman of a company sell via off market 14.82 million shares, just a day before the company was going to announce it's worst financial performance on record?"

The element of insider trading was also raised in i3investors.com website here.

Its tempting to infer Eddie as having possession of the results and acted on the information to dispose his shares and presumably cut his losses.

In Lew Chee Fai, Kevin v Monetary Authority of Singapore [2012] 2 SLR 913, the Singaporean Courts found that quarterly financial results are considered material information.

Eddie may have committed a criminal offence of insider trading under section 188 of the Capital Markets and Services Act 2007 (Act 671).

Missing cash? Authorities?

Nuclearbursaman revealed here that from the end of June till end December 2022, RM11 million may have vanished from the company.

RM23 million from the cash position wiped out. In addition, the company is in negative cashflow.

He questioned why MSWG and SC failed to alert the shareholders and public.

There is a possibility Eddie or whoever he is holding for may be stuck in the share market and faced margin calls. It explained for his shares sales.

Nuclearbursaman highlighted here a peculiar comment about the revenue from electronic transaction being negative. The money received should match the payment to merchants!

He repeated his call on MSWG and also mentioned Bursa. Since it involved payment system, BNM should be have been aware of this.

More weird is the company's note on the accounts. How could Bursa accept such answer and not notice the flaw?

Check with any professional accounting body, and they will say being investigated is not a valid reason not to audit the accounts.

Gaining attention

Nuclearbursaman claimed here that The Star is pursuing the insider trading story. Heard NST too.

This unanswered issues will get its prominence. Already, it is three's a crowd. A Malay blog is joining the frey to introduce the matter from Eddie Gang doing a corporate piracy.

The hands of Victor Chin and Leong Seng Wui behind Eddie revealed. And, Victor Chin alleged involvement in a similar manouver on MMOG after an MACC raid.

How will Bursa and MACC response?

Nuclearbursa summed up what the market have been talking below:

The allegations against Brian and Dino Ng, is there are some dubious transactions worth RM400,000, which no special auditor have yet come forward to confirm such an allegation.

BUT in the two brothers absence from the board, Revenue group under Eddie Ng Chee Siong, has been losing on the average RM127,000 daily, everyday for the past 180 days.

WHICH, you reckon is the bigger sum? RM400k in absolute value or more than RM23 million gone in 180 days?

Did MACC abuse AMLA to pursue on the victim than the perpetrators?

It happened at Caely, Green Packet, Revenue, MMOG, Lay Foong and God knows where else.

LayFoong is the egg producing company and the hands of Victor, Leong and Eddie may have contributed to the current egg shortage. So which company will be next?

Has SC not awaken and got their act together after colluding operators in the previous top management left the Commission?

No comments:

Post a Comment