Agendadaily published an interesting to somewhat alarming economic article. Economics isn't exactly their forte but it attracted our attention to read it in full. We found several articles of similar concern.

It is worthy to consolidate the articles in the light of the new Governor appointment for Bank Negara Malaysia. From The Star column here, it is obvious that Tan Sri Dr Zeti, the Bank Negara establishment, the influential hands behind banks and GLCs, and business media are trying to force on PM to promote Deputy Governor, Dato Mohamed Ibrahim. Another two names from within Bank Negara suggested are Deputy Governors Datuk Nor Shamsiah Mohd Yunus and Sukhdave Singh.

Will Najib select any of the three internal offering since BNM was linked to a coup described as the 5 Tan Sri coup to oust him?

Nevertheless, the new central bank head will join the company of other central bankers to come up with a policy to bring the world out of the global recession. From the three articles found, it seemed it is a company of clueless.

By the way, the article published by The Agendadaily was The Economist.

Clueless Economist

Richard Denniss, Chief Economist, The Australia Institute wrote the following opener in his column, "Economists have absolutely no idea what is going to happen to the global economy" in The Sydney Morning Herald:

Economists have absolutely no idea what is going to happen to the global economy in the next 12 months, and our guesses about the world economy over the next ten years have more in common with fantasy than forecasting. The fact that many if our errors 'balance out over time' doesn't make us 'accurate in the long run', it's just proof that we are guessing.

We are pretty good at projecting the near future on the basis of past trends but we are terrible at predicting what we call 'turning points'. In fact, the only recession Treasury ever forecasted was the 2009 one we didn't have. The trouble is that what we call 'turning points', most people call the GFC, the Asian economic crisis, the 1991 recession or the end of the mining boom.

Clueless Central Banker

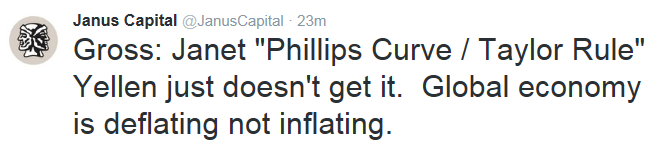

With an alarmist title, "The Fed has no idea what's happening in the global economy. Here it is, explained", Forexlive website published a critical analysis of Fed Chairperson, Janet Yellen.

She does not seem to know what is happening:

For the past six weeks, whenever almost any central banker has been asked about market volatility they've either dismissed it, or placed some kind of vague blame on China.

Today Yellen said the "most notable" reason for worries is that "declines in the foreign exchange value of the renminbi have intensified uncertainty about China's exchange rate policy and the prospects for its economy."

You're telling me that a 1.3% decline in the yuan this year has caused this?

There is one big problem in the global economy and once everyone understands it, markets and central bankers can focus on what needs to be done to counteract and insulate. The problem: Supply.

There is nothing shocking happening in China. Yes, policymakers have stumbled and that's hurt confidence and there are some capital outflows and mixed messages on the yuan. Big deal. Yes, it's an opaque economy and at some point there will be a brutal recession there but there's no evidence that it's happening now.The Economist summed up the state of the global economy in the following excerpt in their article "The world economy ... out of ammo":

World stockmarkets are in bear territory. Gold, a haven in times of turmoil, has had its best start to a year in more than three decades. The cost of insurance against bank default has surged. Talk of recession in America is rising, as is the implied probability that the Federal Reserve, which raised rates only in December, will be forced to take them back below zero.Forexlive reads the situation as below:

Low interest rateslured far too much investment in commodities. Money poured in from markets and sovereign wealth funds into developing every marginal energy or mineral deposit on the planet.

Production is now far exceeding demand and prices are cratering. That's devastating for companies that produce those commodities and countries that export them.

Yes, there are other problems in the world and the global economy is so vulnerable to this because even at full-tilt developed economies can only grind out 3% nominal growth.

But the supply story is what's newClueless Central Bank Policy

Forexlive continues:

If Yellen were to come out and outline the problem, the risks and talk about how the Fed was attempting to insulate the financial system from commodity-driven shocks, then everyone would be better off.

Companies listen to central banks and this is what happens when central banks don't know what's going on.The scarier description was from The Economist:

"There seems to be an emotional reaction that's occurring right now," Cisco CEO Chuck Robbins said today about the economic climate. "You see the markets get rattled, which causes our customers to get concerned, which causes them to tap the brakes, which causes CEOs of public-traded companies to be cautious, which then rattles the markets more -- which creates this vicious cycle. We have to be careful that we don't create some self-inflicted dynamic here."Central banks need to wake up and provide some clarity. This is the age of oversupply. It's not just commodities; there is no scarcity any more. It changes every economic model and they absolutely don't understand it.

One fear above all stalks the markets: that the rich world’s weapon against economic weakness no longer works. Ever since the crisis of 2007-08, the task of stimulating demand has fallen to central bankers. The apogee of their power came in 2012, when Mario Draghi, boss of the European Central Bank (ECB), said he would do “whatever it takes” to save the euro. Bond markets rallied and the sense of crisis receded.Operating in concert

But only temporarily. Despite central banks’ efforts, recoveries are still weak and inflation is low. Faith in monetary policy is wavering. As often as they inspire confidence, central bankers sow fear. Negative interest rates in Europe and Japan make investors worry about bank earnings, sending share prices lower. Quantitative easing (QE, the printing of money to buy bonds) has led to a build-up of emerging-market debt that is now threatening to unwind. For all the cheap money, the growth in bank credit has been dismal. Pay deals reflect expectations of endlessly low inflation, which favours that very outcome. Investors fret that the world economy is being drawn into another downturn, and that policymakers seeking to keep recession at bay have run out of ammunition.

In an effort to boost the economy, policy options being explored to bazzoka the economy as reported by The Economist include:

Plenty of policies are left, and all can pack a punch. The bad news is that central banks will need help from governments. Until now, central bankers have had to do the heavy lifting because politicians have been shamefully reluctant to share the burden. At least some of them have failed to grasp the need to have fiscal and monetary policy operating in concert. Indeed, many governments actively worked against monetary stimulus by embracing austerity.Fiscal and monetary policy operating in concert is not something monetarist cheerish but that has been what Malaysia been doing all through it's existence as a nation. Monetarist believe that monetary policy is so powerful that by itself can inflate or deflate the real side of the economy.

The Economist continues:

The time has come for politicians to join the fight alongside central bankers. The most radical policy ideas fuse fiscal and monetary policy. One such option is to finance public spending (or tax cuts) directly by printing money—known as a “helicopter drop”. Unlike QE, a helicopter drop bypasses banks and financial markets, and puts freshly printed cash straight into people’s pockets. The sheer recklessness of this would, in theory, encourage people to spend the windfall, not save it. (A marked change in central banks’ inflation targets would also help: see Free exchange.)And, Malaysia explored such risky policy option via BR1M and high income economic policy. So it is not coming out of thin air though it is certainly not something traditionalist would cherish.

Another set of ideas seek to influence wage- and price-setting by using a government-mandated incomes policy to pull economies from the quicksand. The idea here is to generate across-the-board wage increases, perhaps by using tax incentives, to induce a wage-price spiral of the sort that, in the 1970s, policymakers struggled to escape.

All this involves risks.

Where possible, the traditional borrowing for public spending to get out of the current rut is still an option:

Elsewhere, governments can make use of a less risky tool: fiscal policy. Too many countries with room to borrow more, notably Germany, have held back. Such Swabian frugality is deeply harmful.Another policy option that could be explored is deregulation.

Borrowing has never been cheaper. Yields on more than $7 trillion of government bonds worldwide are now negative. Bond markets and ratings agencies will look more kindly on the increase in public debt if there are fresh and productive assets on the other side of the balance-sheet. Above all, such assets should involve infrastructure. The case for locking in long-term funding to finance a multi-year programme to rebuild and improve tatty public roads and buildings has never been more powerful.

Forexlive also believed that companies should not wait for central banks:

At some point, the Fed, executives and markets are going to get a handle what's going on. I think that might be good news. The companies -- like Cisco -- that are largely removed from commodities can resume spending and investing. They can avoid commodity-exporting countries like Brazil invest in importers like China and the United States.Dragging on

However Forexlive see that:

The risk is that this drags on. That the Fed and other central banks remain utterly clueless and all companies retrench into the self-defeating vicious cycle Robbins outlines.The Economist see it as political problem:

At the moment, you just can't make any kind of bet that central bankers will soon 'get it'. What's really needed is a wholesale clear our of central banking circles and to put some fresh thinkers in charge.

The problem, then, is not that the world has run out of policy options. Politicians have known all along that they can make a difference, but they are weak and too quarrelsome to act. America’s political establishment is riven; Japan’s politicians are too timid to confront lobbies; and the euro area seems institutionally incapable of uniting around new policies.SMH concur:

If politicians fail to act now, while they still have time, a full-blown crisis in markets will force action upon them. Although that would be a poor outcome, it would nevertheless be better than the alternative.

There are storms on the horizon and Australia does need to plan for the future. The decisions our representatives make on behalf do matter, and if we ignore problems we will make them worse. But the idea that the only thing we need to do to prepare for the future is to invest less money in education and health and lower the safety nets that those who become sick or unemployed fall into has no basis in economics.Something Malaysia has to ponder in facing up to budgetary contraints.

7 comments:

Are you prepared to bet against the Fed, PBOC, ECB, BOJ etc?

Or, closer to home, the MAS?

Commentaries are a dime a dozen. How many of these commentators actually have "skin in the game"?

Frankly If you want skin in the game, look no further than Dr.Suresh Ramanathan, a lot of skin and a lot of guts. Correctly predicted the USD 30/35 per barrel for oil way back in December 2014 which was circulated to every GLC in town in December 2014. He still sees the Ringgit under pressure hitting the 5.0 handle in Q1 2016, still sees the risk of a technical recession in 1st half of 2016. And by the way his views are all over town even in Bloomberg KL. The biggest bear in town is right in your midst. Now you want skin, its all yours.

No, stupidity need not be banned. Just delete. Easy ...

Central bank job is to execute monetary policy with alignment to government economic growth. And to a certain extend to monitor and regulate banking and financial system. Why make so complicated and look as if doing power wrangling job. If that's the case just like MNY that used forex reserves into trading activities. And what about some central bankers in cahoot outsourcing minting coin but short changing coin precious metal content. What's happening to this Malaysia government entities.

If central bankers are good in doing analysis please go to JP Morgan or goldman Sachs to earn fat income. But then not yet they wouldn't take you unless you work internally in concert beforehand for them to earn ton of profit. Otherwise go fly kite.

So please make thing simple

Why do we need central bankers that follows the world trend. I.e. merging and acquistion. Is getting bigger capital and one big super bank make good financial system. Does it help local growth like SME to borrow money. Does it have strength in human capital? Why so many ah long in the market ! Why now all this super bank only goes to retail market and used wallet sizing and profiling. That mean credit rationing is the game for the bank. So called less risk and astute to lower NPL. So what do central bankers do actually.

More bankers on the street, more bancruptcy in retail sectors, and ah long now goes door to door service. So what kind of central bankers we have.

Post a Comment