Blogger turned Facebooker Azmi Ibrahim was making fun of Tun Dr Mahathir's remarks:

It attracted reacted with social media raising on his and the family's questionable Islam liberal leaning. The statement meant differently but still could be debated along the argument of hypocrasy.

Lets not go to length of their religion since this posting is about the piggy issue of higher cost of living.

The Mole columnist on political economy wrote on the subject: Strumming the right chord on cost of living. He also touched on the study by Isham Jalil, the Special Officer in PMO.

Isham found that property prices was a major contributing factor for piggy populated Selangor and Penang throughout the 2009-13 study. [Read HERE.] Its not entirely GST la Munge Laye.

BNSC Eric See-To commented HERE on the matter raised by EPF Chief Economist and HERE on Penang. So the blogger Hisham left ISIS, the think tank institute not the terrorist jihadists, for EPF.

Econ Malaysia commented:

.... Property related taxes have increased across most states, and in my opinion probably a bigger factor in the increased cost of living than anything else.

We can all argue over who is at fault, but ultimately, nothing much will change unless fundamental reforms are carried out.

State finances.

The real heart of the matter here is state finances, particularly in the raising of revenue. Something like 70%-80% of state revenue comes from property taxes of one sort or another.

I actually don’t mind if this was raised via quit rent or assessments, which directly taxes home owners. These are, in economic terms, efficient taxes – those who consume public services are also the ones who pay for them.

Unfortunately, most of the increase in revenue comes from a different source – land conversion premiums and development charges.

Unlike direct taxes like quit rent and assessment, these are hopelessly inefficient.

Here’s why: premiums and charges are paid by land developers.

Since these add on to the cost of housing, the price of new homes must rise (holding profit margins constant).

But the way the housing markets work is that changes in transacted prices form benchmarks for existing housing, since valuations depend on market prices. So the additions to housing supply have the effect of raising the value of ALL housing, and not just for the new units.

This results in a windfall for existing home owners, for which they are NOT taxed (except minimally via marginally higher quit rent and assessment on the higher value of their property).

As a result, on the one hand, the burden of taxation falls primarily on new home owners while existing home owners get a free ride.

On the other hand, the state government raises revenue, but only on the value of new housing and not the total increase in wealth that results.

Effectively, there’s a wealth transfer from new home owners – and by extension, all future generations of Malaysians who have to live with higher prices – to existing home owners. In other words, raising revenue this way contributes to an increase in wealth inequality.

Note that I’m not arguing here for a unilateral cut in taxation. States have a legitimate need to raise revenue to pay for local public services. The almost total reliance on property taxes however means that state governments have a vested interest in keeping property prices going up, with all that implies in terms of raising wealth inequality.

Or, as the immortal Sir Humphrey Appleby put it, “If you must do this damn silly thing, don’t do it in this damn silly way.”

Fixing it ...

One way to fix this is to shift the burden of taxation from indirect to direct – reduce coversion premiums and development charges while raising the more efficient quit rent and assessment to compensate.

Not only will this be fairer but it should also increase housing supply, which is another contributory factor behind higher prices.

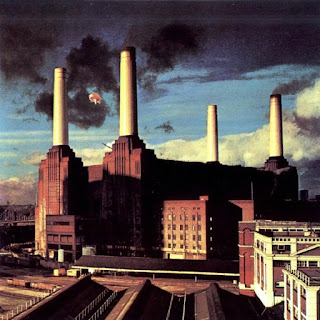

Given the political fallout such a move will cause, this will probably happen when pigs fly.

Another alternative is a land value tax, which I talked about here. I’m not too hopeful about its adoption either.

Ultimately, what’s really required here is a total revamp of state finances.

In other countries, sub-national authorities have the right to levy their own income and sales taxes.

India’s GST implementation last year, for example, was more about streamlining existing the GST regimes run by each state, more than a national imposition of a new tax.

In the United States, most states levy their own income taxes on top of sales taxes.

One possible idea here is a revenue sharing formula of federal government GST proceeds with states, which may or may not require an increase in the rate.

Or alternatively, states can levy their own VAT on top of GST.

But state finance reform would require rethinking and renegotiating the relationship between citizen and state government, and between federal and state governments. The likelihood of that happening?

I think I’ll sit by the window to wait for the pigs.

Faced with conflicting interest of their constituencies and different racial interest, politicians are likely to do nothing for fear unforecasted turn of events become politically costly.

With the majority Malays divided by moves to split the major parties of UMNO and PAS, another round of tax reform as taboo of pigs to Muslims.

Price rise due to property price increases will continue and seep into cost of living. All sides in the political divide will only blame each other.

If you didn’t care what happened to me

And I didn’t care for you

We would zig zag our way through the boredom and pain

Occasionally glancing up through the rain

Wondering which of the buggers to blame

And watching for pigs on the wing

So Hisham and the likes of Hisham will have to wait for those pigs on the wing flying over Battersea Power Station.

No comments:

Post a Comment