"At the peak of CPO price, value of land for oil palm plantation of similar acreage never reached half of United Pontian Plantation (United Pontian) valuation," said one old hand Sabah-based corporate player with confidence.

Before anyone make the presumption to accuse us of raising this issue to sidetrack Tan Sri Isa Samad's second attempt for UMNO Vice President, do keep such thought within their own chicken coop of shallow political game with endless conspiracies and money inspired motivations.

To understand that there was no malice intended, this blog debunked certain perception against Isa and promoted him to run at the Bagan Pinang by-election and turnaround BN's fortune. And this blog also chorused the defense of Felda Global Venture (FGV) listing.

So it is not about UMNO party election but concern for the promised future generation of Felda in the FGV listing. Concern on the presence of Emir Mavani in FGV went back earlier to June 2013 [read back here]. This is just about being persistent.

Again, it's got nothing to do with UMNO election.

Eyes wide open

As far as we are concern, Isa is an old hand and quite capable of handling his political affair. With his common folk touch, he has put side issues made against him as another poison letter of the past. [Read Utusan here.]

The answer to those trying to sweep things under the carpet is persistency.

The Malay has a proverb. "Seekor kerbau membawa lumpur, semua terpalit." It means a buffalo carrying mud will taint all others with mud. This is not a buffalo one is talking about but a koliang taik palat, as the Minang would say.

If that is not crude enough a message, please be reminded: If Emir Mavani's shit hit the ceiling, the whole member of the Board of Directors and other stakeholders of Felda will have shit splashed all over.

If anything happen to Isa politically, it is merely collateral damage. Isa's campaign for VP is number-focused for the Felda-linked divisions.

However, the implication of Emir Mavani's action could politically affect UMNO's Felda electoral stronghold. Using simplistic excuse like it is collective decision and such will be not sufficient because it is recycled argument.

Something to be concerned off for the GE14.

Nevertheless, there are those who believed that Isa is merely a pensioned school teacher and an innocent bystander. His presence in Felda and FGV is political. It is the CEO Emir Mavani that is the culprit.

Unfortunately, the law and public does not read it that way.

The word fiduciary duty in the Company Act makes no exception for retired teacher. What more, Isa has stopped teaching at SDAR ever since we left Seremban to study in the US more than 35 years ago. He is known more as a former Menteri Besar of Negeri Sembilan.

Few information has surfaced to indicate that Isa may not be such an innocent bystander. It was recently made known to us that there was a gentleman agreement to give grace to Emir to resign within six months but was stubbornly ignored by Isa.

Furthermore, Isa was accused of being mean and vindictive towards bed-ridden and hospitalised former CEO Tan Sri Sabri for blocking the FGV's the Papua New Guinea deal. The Company Secretary made a false report to Bursa Malaysia to cover-up. [Read in Rockybru here].

In addition, it has come to our knowledge that the previous Company secretary and a Board member were removed for cautioning the Board member on certain issues. But, this is covered up by not updating of FGV's website of recent board changes.

It is expected upon Isa to do and decide with his eyes wide open. Thus it means, Isa has to answer for it and not swipe it off as another poison pen letter. Again and again, it is strictly business and not politically motivated.

Super-premium acquisition

Enough on Isa. Let's get to the fact of the matter.

On July 17, FGV launched a takeover of Pontian. They offered RM140 per share which values the entire company at RM1.2 billion. This offer was 56% higher than the RM90 per share made by TSH Resoources (TSH) and the Lee family of Seremban last year but payable in cash and shares.

Pontian owns more than 16,000 hectare oil palm estate land in Lahad Datu, Sabah and Kukup, Johor.

This attracted opposition by Bigdog who argued against it here. He managed to get the attention of Utusan Malaysia which reported on his piece on July 22nd here. The argument will be discussed later.

On August 7th, The Edge here reported the major shareholder, Chairman Dr Chen Man Hin agreed to seel and advised other shareholders to sell too. It was reported that FGV had managed to get an irrevocable undertaking from the TSH and the Lee family to sell their 23.81% stake.

Although it was initially doubtful that the deal could go through because of the fragmented shareholding, The Sun reported on September 18th here that FGV managed to successfully acquire 98.81% in Pontian.

Nevertheless, FGV did extend the closing date till October 1st and it expired last week.

The initial argument against FGV was that:

- At RM90 per share, the offer by TSH at Price Earning ration of 14 was relatively expensive, earning wise. It is not a listed company to warrant such high PE.

- CPO was at RM2,300 per ton at the time of TSH offer but now cheaper.

- FGV could be biting more than it can chew. At the time of offer, FGV had just announced 2 weaks earlier the plan to spend RM283 million for the development of oil palm plantation in Kalimantan over the next 5-6 years.

Using Enterprise Value, the sector average for EV/hectare is RM51,000 per hectare. Thus RM74,800 per hectare is too pricey. Pontian is also worth only RM825 million.

CIMB analyst Ivy Ng felt Pontian's palm oil tree are at their prime or past their prime, thus it means FGV will have to pump more money. She too agree that the PR is to high.

Read the extensive article on analysts' views here.

In defense

Since the vendor is former DAP Chairman, Dr Chen Man Hin, it is not coincident but convenient for The Star, Sundaily, and perhaps other English business newpaper are defending the valuation of Pontian.

Any deal involving a Government or Malay owned corporation would usually attract the harshest critic from the Enlish and business media but not this one.

These days it is the general Chinese thing to defend anything Chinese, rightly or wrongly. SInce it involves a fellow DAP, weve yet to hear anyone from PAS making an issue out of it. Hai O! To the Boss!

From The Star article dated August 3rd here, we extract below:

When Felda first announced its acquisition in Pontian on July 18, Felda explained that the offer price of RM140 per Pontian share represented a price-earnings multiple of approximately 21.8 times based on the average earnings per share of Pontian of RM6.43 for the past two financial years ended Dec 31, 2011, and 2012.Minus the RM256 million cash, the land cost works out to between RM65-67,000 per hectare. Emir claimed here IOI paid RM80,000 per hectare for Unico-Desa plantation land in Kinabatangan dan Lahad Datu. FFB yield in Sabah is higher than in Peninsular.

Pontian also has net asset per share of RM47.87 and RM44.91 respectively for 2012 and 2011.

Pontian delivered revenue of RM262.18mil and RM174.96mil in 2011 and 2012. Net earnings was RM84.44mil and RM46.35mil respectively during that period.

Thus, at RM140 per share, Felda would be acquiring the company at 2.92 times book value.

To quote from The Star here, below:

A plantation analyst contacted explained that the value of a plantation company was more accurately depicted on its price per hectare. In the case of Pontian’s land, it would be RM75,000, which is fair for a brownfield.There is also an unpolish diamond in the form of Pontian's plantation in Kukup, Pontian which is within proximity of Tuas highway for future development in Iskandar, Johor. How big and significant can it be for the future?

“Brownfield land typically starts at RM60,000 and above depending on where it is, and the age profile of the trees,” said this plantation analyst. She feels that the RM140 price is fair. In fact, she felt that TSH was underpaying when they offered RM90 per share the year before.

More questions

No one wins but the owner in an issue over valuation. Valuation is a subjective matter.

However, FGV is a politically sensitive shares and dicey arguments puts the government and ruling party in a difficult situation, politically.

In this case, FGV is allowing Dr Chen Man Hin an exit into their lifelong investment. Who knows, it could be meant to finance DAP for the next general election.

If that is what the ruling party BN is comfortable, so be it. Isa can tell the politcal grassroot that the Pontian deal was to pave the way for an UMNO-DAP peace initiative. He may have sense it is not easy for Mazlan Aliman to make an issue since he is buying from former DAP Chairman.

Being able to kelentong the grassroot does not mean it will help to clean any tainted image for being associated with Emir Mavani and one Dato Chinese man in the Investment Committee. FGV website is not transparent to rveal who are the members of the Investment Committee.

Nevertheless, there is an important point that has not been considered by all these analyst and FHV management. Land prices for palm oil plantation is cyclical and subjected to the vagaries of the CPO market.

When TSH made the RM90 per share offer, it was almost exactly one year in mid September 2012.

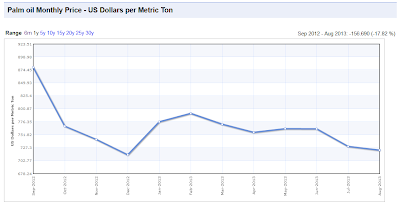

From the chart above, it was about the time before CPO plunge from RM3,000 per metric tonne level to the RM2,300 per metric tonne level.

CPO reached it's peaks of the last cycle at RM3,933 per metric tonne at around February 2011 and RM3,604 per metric tonne at about April 2012.

In the previous CPO cycle, the peak was RM4,099 per metric tonne in 2008.

This year CPO prices is still the doldrum. See chart above. Experts say it could fall another 13% and hit down to RM2,000 per metric tonne in 2014. Read in The Star here.

We are not comfortable to hear newbies Emir Mavani make such optimistic comments and reported in Sun here, below:

He is predicting crude palm oil (CPO) prices will pick up in the first quarter of next year to the RM2,400-RM2,500 per tonne levels.Not only the timing for such high price does not tally with current market price of CPO, FGV may have bought Pontian at too high in the top. A further fall in CPO will only cause devaluation in assets.

"If soybean prices go up higher, there is a chance of CPO prices following suit," he said, adding that CPO prices are now hovering at RM2,350 to RM2,370 a tonne and will remain at the level for the next two months.

Why then did FGV commit RM1.2 billion or 34% of the 3.5 billion raised via public listing to merely increase landbank by 4% and increase in projected earning for 2014 by only 3.55%?

[Addition: 5:00 PM]

On top of that, the whole deal was transacted in cash, the whole RM1.2 billion sum? Perhaps, being just listed, it is too early to go back to the capital market for funding. But, there is always the bond market and banks.

Any corporate finance man knows the benefit of leveraging to increase capacity to invest.

More concern.

Emir Mavani said FGV will use the remaining RM2.6 billion of funds raised for acquisition of at least 5,000ha of land in Myanmar and Cambodia for rubber plantation.

FGV is the biggest palm oil plantation in the world. Why the hurry?

If the game he is doing to give RM100 per tonne discounts to Felda IFFCO [read Bigdogdotcom here] is any indication, MACC should come in to raid FGV. It smells kickback and the many hurried acquisitions smells kickback too!

Too many funny story from this CEO from PEMANDU. Not just about being a cheapskate to take two salaries at one time.

He certainly look good in shorts and slippers ... like a prison inmates!

11 comments:

It is to be used for election fund la bro... One for the general election and the other one is for umno erection..

Najib wont be dummest of all right? Otherwise 3 million UMNO memmbers wont returned him as President unopposed. It a stamp that what going on is non issues. Najib blessed Emir. No need to kacau kopi in a cup. We trust Najib.

As Isa Said, what he did for FELDA is purely business. The UMNO elections is a party matter and should not be confused with business decisions.

If the business decisions of each and every aspirant contender is to be considered then, to be fair, the others should also come under scrutiny including Najib Razak and Muhyideen.

How about Mukhriz? Was he not involved in businesses with the Philippinoes in St Miguel (some may suspect he still is and using proxies).

Remind me of the untouchable NMY...

Looks like somebody is holding someone ball.

A standard rule of thumb for oil palm plantations is the larger the acreage the cheaper the price per hectare/acre. In 2002, the price in the same area was only RM9,000 per acre transacted. Each plantation needs to have 30% of its acreage under re-plant at any one time, 30% is young palms and 40% mature. A buyer just does not pay top price for the whole estate no matter the valuation ! This is agronomics.

bro,u r a sdarian as well as a jb guy ke?same breed here bro.

12:07

Unfortunately, we are ANSARA.

Growing up in Seremban, we have fond memories of SDARIANs and your teacher like Isa.

Remembered Isa was the Sepak Takraw coah for SDAR and we met them in the final.

In the early rounds we met Isa's team and lost. So we had to psyche Isa's highly disciplined team.

It started with Isa downgrading us as sekolah rakyat. Before we were syche badly by Isa.

Instead of being insulted, we were actually proud as being school for rakyat.

In return we psyche Isa and got him to lose focus. Pemain takraw tinggi tapi coach pendek. His team crumbled 0-3.

But till day, Isa never acknowledged his team lost in the final. He must be thinking about the premiliminary.

When it comes to hockey, MRSM, SDAR and KGV would cheer each other and help out in any possible fist fight.

Asal bukan St Paul's .... hehehe

Joe Black

Mukhriz and St Miguel? Get your facts right .....

Why would FGV need to spend RM1.5 bllion on a brownfield when they can earn more by developing greenfield plantation?

Spending that much for only a miniscule increase in earning and acreage smells corruption and kickback.

FGV can buy into better areas with better soil, and other more favourable condition. Sabah is not high in the list for good yield. Neither is Cambodia and Kalimantan.

This Isa and Emir know nuts about plantation!

For a fact, buying a matured plantation means spending more for future replanting, fertilizers, retreating of soil, and fruitation period.

Undoubtedly, something smells.

'

'

'

'

'Sementara banyak mat mat pro umno yang

bolih beri justifikasi dasar pelaburan

Felda atau syarikat bersekutu dengannya,

tak nampak ada pencerahan atas dasar apa

Felda itu telah di mulakan olih gomen

UMNO pada tahun 60'an itu.

Mungkin kerana kurang perihatin kepada

applikasi pada base inggeris , banyak

mat mat tak sedar FELDA adalah satu

badan berkanun yang membawa erti Federal

Land Development ...

Dalam base melayu - Pembangunan Tanah Persekutuan...

Saya kenal tokey tokey yang buka tanah kerajaan negeri

beribu ribu ekar untuk menanam sawit dan dapat

menjana pendapatan yang sangat lumaian -yang data keluaran

nya saya rahsiakan untuk kepentingan saya dan meeka!

Prinsip pelaburan bukanlah se simplistik bagaikan -

Beli hotel 100 juta pound , kepulangan jika jual

esok dapat 105 juta pound. England pun ada undang

undang yang tidak menggalakan spekulasi hartanah, ooi!

Teksbook investment strategi memaksa satu ceo memilih

'the best resource allocation' to get the best ROI.

[Return On Investment ] Mat mat opiser gomen

pun kena tunjuk ROI yang

munasabah di dalam bajet tahunan untuk memohon kelulusan

projek baru dari kem kewangan! Biasanya around 10-13 percent

selepas di discount mengikut skala pinjaman bank bukan

berdasarkan simple interest! Jadi apa yang di ujar dek

Isa samad dan geng geng sekapal dengannya bolihlah

di tongsampahkan saje!

Akhirkata ada cara lebih baik jika felda balik

ke pangkal jalan- develop tanah hutan atau

tanah yang terbiar dikampong kampong yang

jika dijumlahkan mungkin ada berpuluh ribu ekar.

Adalah lebih baik jika felda 'headhunt' ceo ceo

yang berjaya di industri plantation tempatan

dan jalankan bisnis dari a-z dari mengupah

satu koliang dari Dubai dari sektor marketing

[kelulusan warnborough collegenya yang mungkin

sama taraf dengan diploma Goon Institute]

untuk membeli aje ready-made plantation companies

sebagai strategi bisnis. Kelebihan strategi ini

tuan tuan sendiri bolih senaraikan. Ikut satu

kawan sekerja saya dulu- Felda telah meletakkan

'square pegs in round holes' . Ingat bukan

pelaburannya kini tak untung- tapi ianya tak

optimum. Bagaikan Mat isa samat pandu

BMW M6 , tetapi memandu di lorong tepi di highway!!!

Mat kampong-always a mat kampong!

.

.

kkk

.

.

.

Kickback from this deal is used for VP election. Money is already passed out. So can' t catch Isa again. Money passed last week together with t shirts. Focus is in the felda areas. Dont't discount Isa.

Post a Comment