He was replying to a request from a member of Parliment from Kuala Terengganu, YB Tuan Haji Ahmad Amzad bin Mohamed @ Hashim for the list of assets being transfered to the SPV under Ministery of Finance, Syarikat Urusharta Jamaah Sdn Bhd. [Full statement at end of posting].

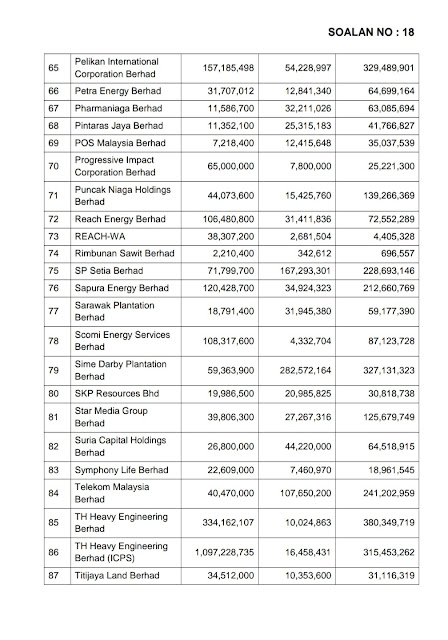

In his reply, he told the assembly that the asset are being transferred at a value higher of RM19.9 billion than the current or book value of RM10 billion.

Since MFRS 9 is taken as the new accounting policy of TH and the sukuk yand i-RCPS being exchanged for is "not guaranteed, not-traded and not rated", the accepted practise under MFRS 9 is to impair the unguaranteed instruments.

In his effort to politically blame the previous government for not complying with Section 22(3)A of Tabung Haji Act 1995, which require asset must exceed liabilities by kitchen sinking the accounts and manipulating accounting policies, TH do not comply with 22(3)A to give out hibah for 2018.

Any announcement of hibah will be considered, in the terms used by Mujahid himself, as haram or illegal.

The new Auditor General, Datuk Nik Azman will be considered as committing an unlawful act to give any exception to TH from making any impairment!

Noticeably, mainstream media did not provide any coverage to Mujahid answer initially.

It could be at the behest of Tabung Haji's paid public relation consultan Datin Norheyati. However, Malaysiakini and The Edge provided coverage HERE, and HERE.

The Edge TV summarised Mujahid's reply in the video below:

The recent event have been anticipated and written in the two postings HERE and HERE.

Najib wrote in his FB, it is taking TH asset but using money from TH. Earlier he asked as to how could an unguaranteed SPV's IOU make TH's deficit go away?

Obviously, an un-"creatieve accounting". Jawa kutip botol di kampong could do better.

Blame game using Other Reserves

As far as the blame of hiding numbers accusation as claimed by unqualified in accounting and finance Mujahid, the other reserves refers to AFS reserves as required by MFRS 139.

As explained by a qualified accountant,

It is unrealised reserve and under MFRS 9, it is called Fair value to other comprehensive income statement (FVOCI) reserves and no impairment to the Profit and Loss.

Under MFRS 139, the movement will be reflected under other comprehensive income and no impairment on profit and loss. For MFRS 9, all impairment made previous years will be reversed and credited back to retained earnings but the deficit will hit FVOCI so net net still same impact to balance sheet."It is all part of the blame game to manipulate perception using a seldom ignored item on the balance sheet. These are pre-emptive efforts to deviate from the real issue i.e. either low or no hibah. The year 2018 was a bad year economy-wise. Everyone could witness how bad KLCI performed since the result of GE14.

The accountant's is of the opinion that:

Efforts should be made to refocus on what is new management strategy in going forward and how to sustain or generate profit for depositors rather than blaming game. With assets transferred to SPV, it will only defer the issue till maturity date i.e. next 7 years.

What if SPV failed to pay the bullet payment when its due what’s next?

Will the assets then be transferred back to to TH?

They are just shifting the problems but not addressing them. What is to happen with their investments in FGV, MMHE, and other significant loses n their portfolio? What is the government economic policy to help spur economy and attract foreign investors?They need to accept the fact that in 2018, they add on RM5 billion to the RM4 billion within less than a year and they do nothing to curb or contain it.

So much for Islamic Banker of the year and Chairman of MyPAC. Too much credit given to bankers, accountants and so-called turnaround specialist (liquidators).

-------------------

Some corporate players should like to have their hands on strategic stakes in some of those shares. All going at knock-down prices!

No comments:

Post a Comment